douglas county nebraska car sales tax

Registration is required with each vehicle purchase to establish ownership and link the car to the purchaser. If planing to come to our office in person please visit this new location address.

Unisell Auto Serving Bellevue Ne

Copy of current VIN-specific proof of insurance.

. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660 Total. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. This example vehicle is a passenger truck registered in Omaha purchased for 33585.

The Nebraska sales tax on cars is 5. Douglas NE is in Otoe County. This is the total of state and county sales tax rates.

When a motor vehicle dealer exercises the buy-out option for the lessee the dealer may purchase the vehicle without sales tax if the vehicle is being purchased for resale. Douglas is in the following zip codes. The Nebraska sales tax rate is currently.

The minimum combined 2022 sales tax rate for Douglas County Nebraska is. This rate includes any state county city and local sales taxes. The Douglas Sales Tax is collected by the merchant on all qualifying sales made within Douglas.

The 2018 United States Supreme Court decision in South Dakota v. The Douglas County sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The Nebraska state sales tax rate is currently. Douglas County collects on average 197 of a propertys assessed fair market value as property tax.

Money from this sales tax goes towards a whole host of state-funded projects and programs. The Tax Foundation is the nations leading independent tax policy nonprofit. Please call 303-660-7440 or click on the Need Help icon at the bottom right corner of this website to chat live online with a Motor Vehicle Specialist.

The mailing address for payments is 6200 Fairburn Road Douglasville GA 30134 and a drop is located in the parking lot of this location. For vehicles that are being rented or leased see see taxation of leases and rentals. The Douglas Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Douglas local sales taxesThe local sales tax consists of a 150 city sales tax.

Douglas County has one of the highest median property taxes in the United States and is ranked 200th of the 3143 counties in order of median property taxes. Real Property Tax Search Please enter either Address info or a Parcel Number. The County sales tax rate is.

2915 NORTH 160TH STREET. The Tax Commissioners Office has officially moved to our new location of 6200 Fairburn Road Douglasville GA 30134. The cost to register your car in the state of NE is 15.

US Sales Tax Rates. Nebraska has a state sales and use tax of 55. Additional fees collected and their distribution for every motor vehicle registration issued are.

Douglas County NE Sales Tax Rate. The December 2020 total local sales tax rate was also 5500. The County sales tax rate is.

While many counties do levy a countywide. 150 - State Recreation Road Fund - this fee. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

Groceries are exempt from the Douglas and Nebraska state sales taxes. 10 rows Douglas County Has No County-Level Sales Tax. Please contact the Colorado Dept.

The Douglas County sales tax rate is. The bill of sale must be signed by both the buyer and seller. The Douglas sales tax rate is.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. Motor Vehicle Customer Service by PhoneOnline Chat. The Nebraska state sales tax rate is currently.

This is the total of state county and city sales tax rates. Monday Friday 800 AM 430 PM. County in Nebraska in which the vehicle is currently titledregistered.

Early payments for the current year taxes may be processed online starting December 1st with statements being mailed each year by Mid-December. The current total local sales tax rate in Douglas. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

The fee for the temp tag is 703. The latest sales tax rate for Douglas NE. Original or copy of the front and back of the title or a copy of the bill of sale listing the date and time of vehicle sale notarized or signed under penalty of perjury.

200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. The current total local sales tax rate in Douglas County NE is 5500. 2020 rates included for use while preparing your income tax deduction.

Motor Vehicle Dealer Exercises the Buy-out. Car truck for-hire vehicle etc The type of plate you order standard vs. The median property tax in Douglas County Nebraska is 2784 per year for a home worth the median value of 141400.

Lincoln is the capital city of the US. 161 rows ABRAMO JOSEPH C. The minimum combined 2022 sales tax rate for Douglas Nebraska is.

While many counties do levy a countywide.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Vehicle And Boat Registration Renewal Nebraska Dmv

Used Cars For Sale Under 5 000 In Greenville Sc Cars Com

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Motor Vehicles Douglas County Treasurer

Sales Tax On Cars And Vehicles In Nebraska

Vehicle And Boat Registration Renewal Nebraska Dmv

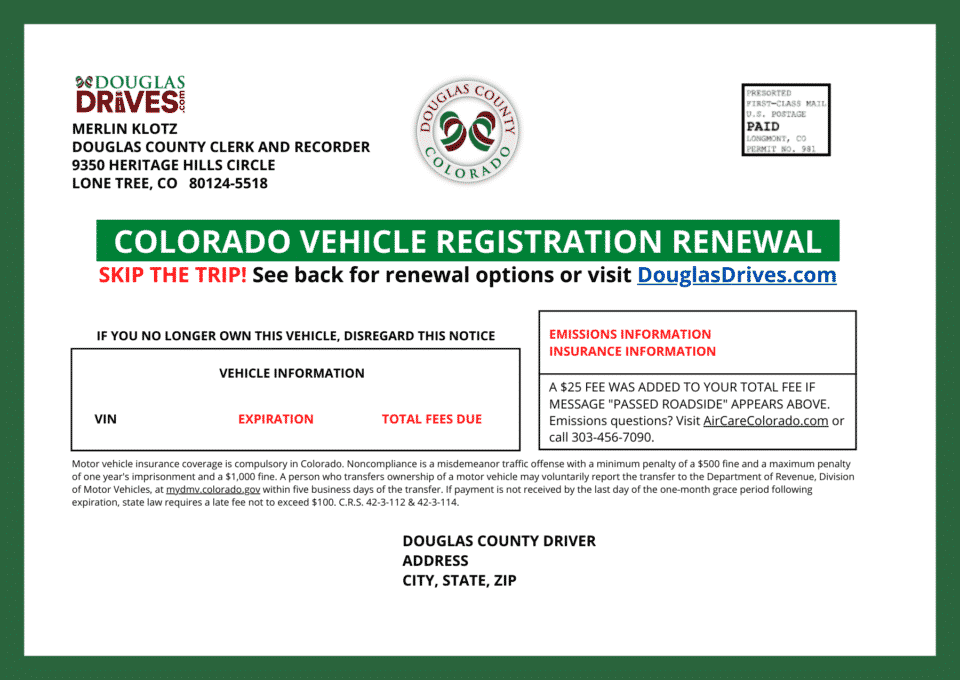

Renew Vehicle Registration License Plates Douglas County

Mobilityworks Buy Direct Wheelchair Accessible Vans Mobilityworks

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Buy And Sell Cars Without A Dealers License Sane Driver

Do You Pay Sales Tax On A Car Down Payment Green Light Auto Credit

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Pin On Minnesota State Records

All About Bills Of Sale In Nebraska The Forms And Facts You Need